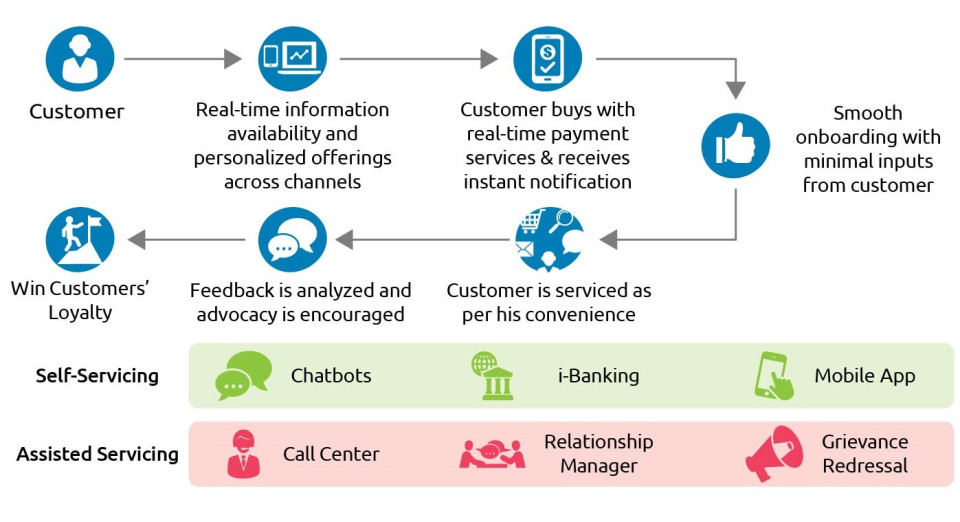

Corporate Banking Customer Journey

The fight for banking customers is increasingly being fought in the battleground of customer experience.

![]()

Corporate banking customer journey. It reduced the number of doc uments required by the process and creat ed a common online workspace that en abled direct and. It introduced a fully digital on boarding process including revamped cus tomer interfaces digital capturing of cus tomer requests and signatures and an automated quality check for uploaded documents. In order to produce this result banks need to. 1 corporate banking clients are no different.

Map out all the interactions that the customer has during hisher. Many banking executives are feeling immense pressure to devise the perfect customer experiencean experience that takes advantage of digitization to provide customers with cross channel targeted just in time product or service information in an effective and seamless way. A customers banking relationship includes key journeys that range from onboarding and transacting to maintenance and problem resolution. Transforming the corporate banking journey 8 months ago.

Why the customer journey in banking will never be digital only subscribe now get the financial brand newsletter for free sign up now in an omnichannel world financial consumers determine what should happen at every touchpoint in the experience. At each of the stages that has been mapped out consider where the touchpoints occur. Effective transformations must not only recognize the complexity of these relationships but must also make a priority of the parts of the experience that matter mostin order to manage the cross functional end to end nature of customer needs rather than. The oxford dictionary defines excellence as the quality of being outstanding or extremely good.

Banks continue to lose many product purchases to competitors. During the next three to five years were likely to see a radical integration of the. A frictionless omnichannel. Hidden customer defection runs rampant with banks neglecting to ask for the sale.

Customer journeys in banking are a bit like a romance from the initial meeting when youre trying to figure out if the bank and its products and channels are right for you to the building of the relationship where of you learn more about each other and finally to the engagement and marriage of what will hopefully be a happy productive and successful long term relationship. When we talk about excellence in corporate banking we mean the capability of a bank to deliver the best possible products and services to their clients at the lowest possible costs and with the lowest possible risk. Just because the journey doesnt start and end digitally doesnt mean that digital isn. Journey to becoming a corporate banking customer.

Customers are pegging their expectations against the experience provided by amazon google uber and many other digital businesses. This pressure is justified. The points of interaction that your customer has with your brand or outside of your brand as they seek to meet their specific goals and needs.